For Many Sellers in Vancouver, Short-Term Gains Are Irresistable

How much longer can values keep going up at this rate? This is a question we are asked all the time, even by savvy and experienced investors who know the Vancouver market well. As we have documented before, there are numerous factors that have driven capitalization rates to an all-time low, many of which are external to the local market.

A trend we have noticed in recent sales however, is that many of the sellers have only held the assets for a few years.

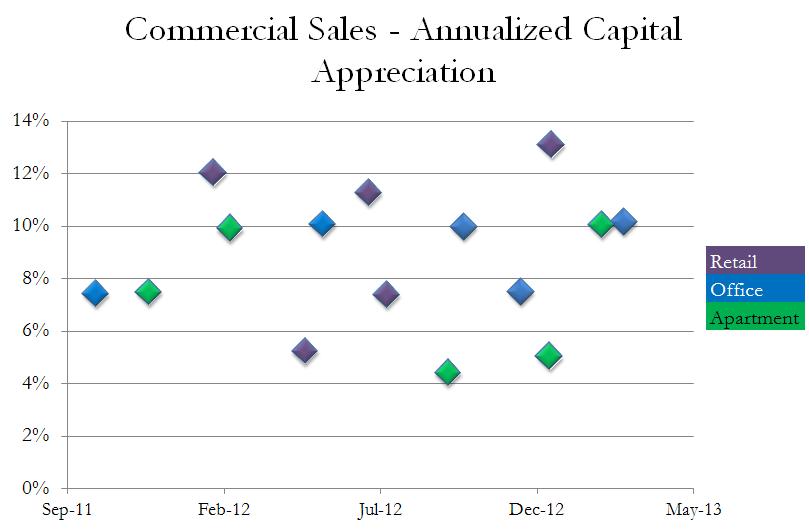

To get a glimpse of what kind of gains these sellers are achieving, we took a look at a handful of sales in each asset class over the past two years. The criteria was as follows:

- Apartment, retail and office properties (5 each) that sold since September 2011 over $5 Million

- Properties that were acquired less than 10 years before they were sold and did not experience significant capital expenditures

From this sample set of 15 sales that took place during this period, the average annual rate of appreciation is displayed below:

Some observations taken from this sample of sales activity:

Some observations taken from this sample of sales activity:

- Average property was held for 5.5 years and then sold.

- The annual appreciation ranged from 4.4% to 13.1%, and averaged 8.6%.

- Notable resales in this survey included: Bentall 5, which was sold by Deka to Bentall Kennedy after 3 years and 10% gain per year. 2450 Ontario Street sold in February 2013 also after 3 years, and also after a 10% annual gain.

- Note that the above data does not even reflect the overall return to the sellers as it does not incorporate the cash flow component of the return during the holding period. While yields have been driven to all-time lows, cash flow has historically been the bigger component of real estate returns. This should be something for all owners and buyers to think about in Vancouver.

This type of resales activity isn’t unexpected in a market that is continually being inundated with capital and buyers, many of whom are new to the market. Interestingly many of the sellers in the above survey are well-capitalized and don’t need the cash, they are simply selling based upon the view that currently achievable values aren’t sustainable in the near term. Our question is (as echoed by our clients): how long can these types of gains last?

In our view, there will be more assets coming to the market as the risks to the provincial and local economic outlook begin to pressure more owners to cash out and realize gains. In most areas, cap rates have no further room to decrease.