For B and C Class Office Buildings, Clouds on the Horizon

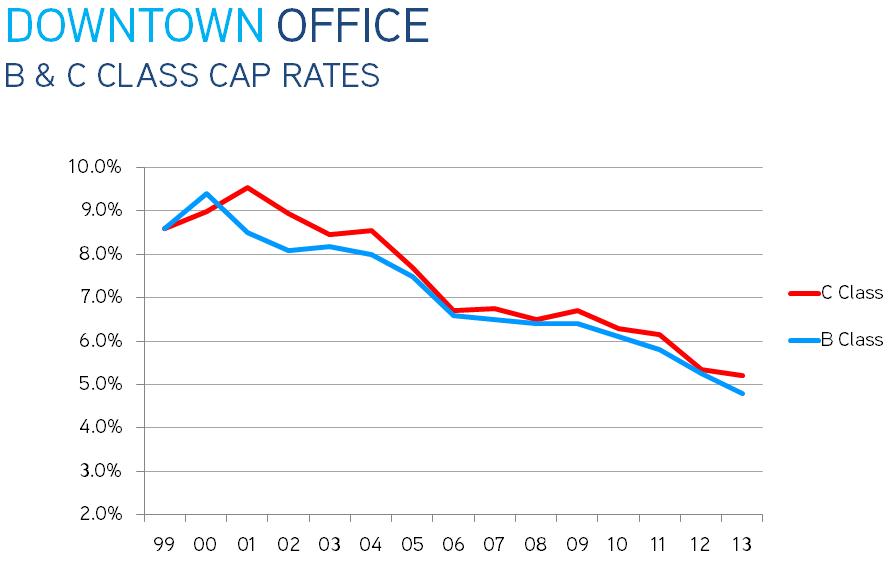

It’s been a great 5 years for owners of the City’s older office buildings. Amid near-record low vacancy and high rents, B and C Class buildings have enjoyed all-time high valuations in 2013, particularly those located in ‘hip’ areas like Yaletown and Gastown. This trend has been exhibited in a number of recent sales, including: 576 Seymour Street, 1445 West Georgia Street and 1112 West Pender, all of which sold at cap rates roughly half of what they would have been just 7 or 8 years ago. Are owners of older office buildings looking to cash out on gains? Well, not really….yet. While many would likely agree that there are risks to the outlook for office leasing fundamentals going forward, vacancy and rental rates are only beginning to feel negative pressure. Here’s a look at some trends in the leasing market:

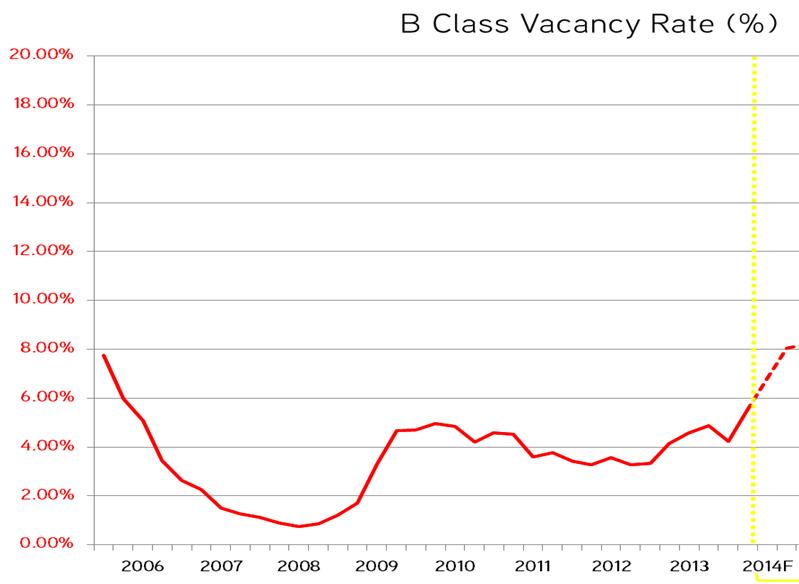

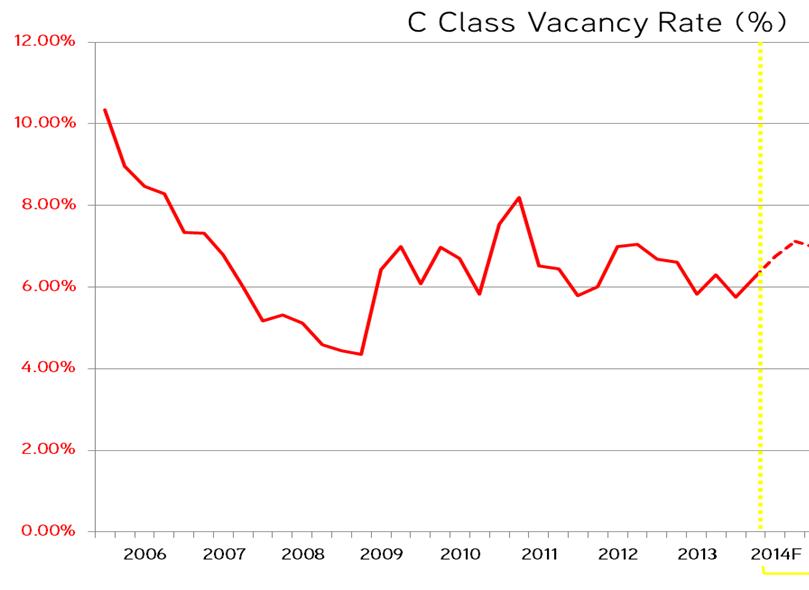

B Class buildings in particular are expected to feel pressure as the upward movement of tenants throughout the market is fuelled by the new construction of AAA Class buildings downtown.

B Class buildings in particular are expected to feel pressure as the upward movement of tenants throughout the market is fuelled by the new construction of AAA Class buildings downtown.

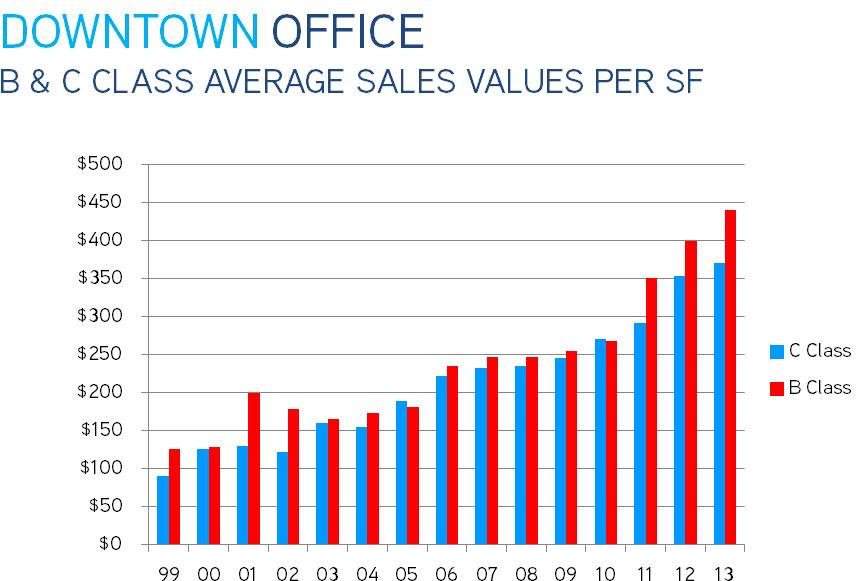

Compare that with the run-up in values over the past ten years:

Ten years ago, half-empty older downtown buildings often sold for as low as $100 per SF, and now they are trading often as high as new product in other markets. Cap rate compression in this subset has also reflected the market at large.

As leasing fundamentals are expected to show a more pronounced weakening around the same time that interest rates finally show upward movement (ie. early 2015), expect to see more activity in this subset of the commercial real estate market, with more sellers looking to cash out on existing tenancies, as well as renewed pressure for conversion to hotel or residential.

Conversion in particular is a much more difficult strategy than it was a decade ago, when the loss of older commercial space prompted the City of Vancouver to initiate a moratorium on the conversion or demolition of commercial space in core areas (the Metro Core Jobs Study).