Amid Swift Unit Sales, Cambie Street Land Values Continue Uptick

The Cambie Corridor Plan has been approved for almost four years now and a great deal has taken place within the plan area from 16th to Marine Drive. The end result of five years of planning and development activity is only beginning to be seen with a handful of buildings sprouting up. Up and down the Corridor, numerous land assemblies have occurred, with dozens of rezoning applications at various stages of the process. Eleven sites have now had rezoning enacted; meaning they have been officially approved by the City.

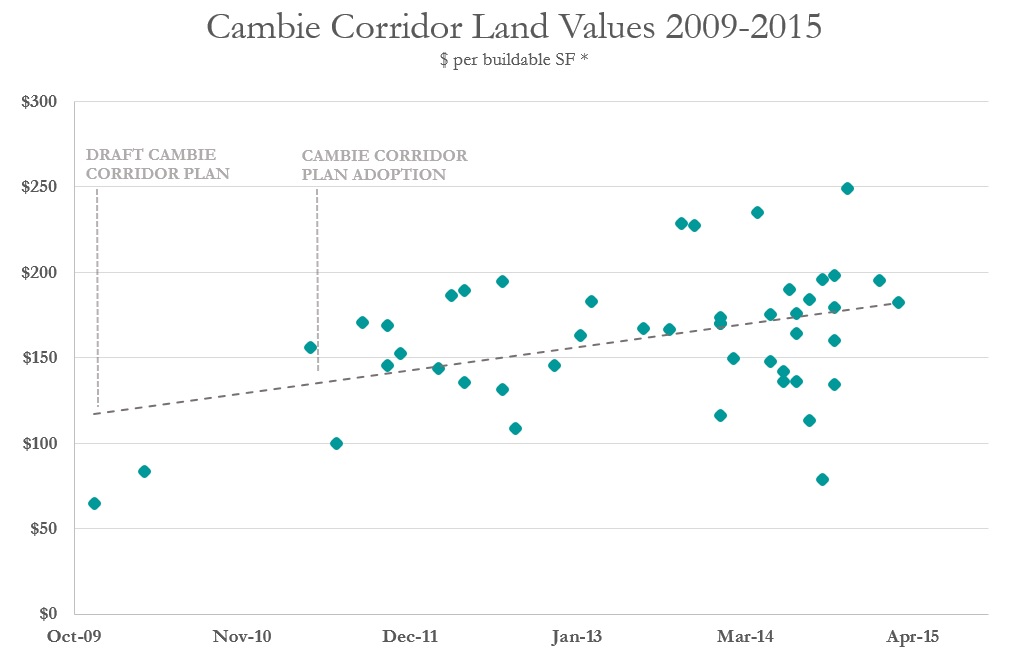

Approximately 28% of the 439 lots in the plan area have now been sold to 42 different developers, and despite a growing list of projects at various stages of construction and approvals, demand from developers continues unabated, particularly for prime locations such as those near Queen Elizabeth Park and Langara Golf Course. The result has been an increase in land values of almost 20% since the Cambie Corridor Plan was adopted by Vancouver City Council in May 2011.

The following chart depicts all of the site/land assembly sales that have taken place within the plan area since 2009.

So why are values going up despite an increase in the number of projects coming down the pipeline? Two underlying factors appear to be primary valuation drivers for Cambie land sales, particularly over the past 18 months.

First, a handful of projects have now gone into the marketing phase and have achieved very strong sales in terms of both pricing and sales velocity. In desirable areas of the corridor, woodframe product in selling in the $650-$700 per SF range, and concrete product is selling in the $775-$825 per SF range. Clearly there is a market for new condo product anywhere on the Westside of Vancouver, and Cambie’s accessibility and proximity to transit, parks and schools appeals to many buyers. Developers such as Mosaic Homes and Intergulf have been able to capitalize on this demand.

Secondly, the Cambie Corridor Plan facilitates a relatively straightforward rezoning process that is difficult to find elsewhere in the City. Opportunities for densification in other areas of Vancouver are now almost entirely limited to commercial strips such as Broadway with existing zoning for mixed-use multifamily. With public pushback to other planning efforts in such areas as Grandview-Woodlands where public consultation is being prolonged at the behest of vocal community organizations, developers are forced to concentrate their efforts to the path of least resistance. The Marpole Community Plan was also approved in 2014, though is far less ambitious than Cambie, partially as a result of public opposition, and will result in far fewer rezoning applications and developments.

With a dearth in supply of new sites for development elsewhere in the City of Vancouver, Cambie Street land values will likely continue its steady upward march so long as attendant condo demand continues to be strong.