Somewhat hidden behind the news of the Housing Vancouver Strategy announcement, is a new policy proposal for CACs for commercial and rental-only residential developments. The overall plan proposed in the policy report entitled “CAC Policy Update: Simplifying CACs on New Rental Housing and Commercial Development” is to cease negotiating CACs on commercial rezonings and some rental rezonings.

The City’s proposal is intended to “simplify the City’s development contribution system which includes DCLs, CACs, density bonusing and other mechanisms. The proposed changes will provide greater clarity and certainty on development contributions for rezoning applicants. The recommended changes will streamline the CAC process for both secured market rental and commercial-only rezoning applications to enable a majority of these project types to be brought to market sooner.”

The recommendations in the proposed policy include the following:

Recommendation A – Exempt routine, lower density secured market rental rezoning applications from CACs

The City would exempt rental applications from CAC negotiations where the density proposed is low, or consistent with area zoning. The table below shows where CACs would be exempt for rental based on height guidelines:

Recommendation B – Remove CAC negotiation on commercial-only rezoning

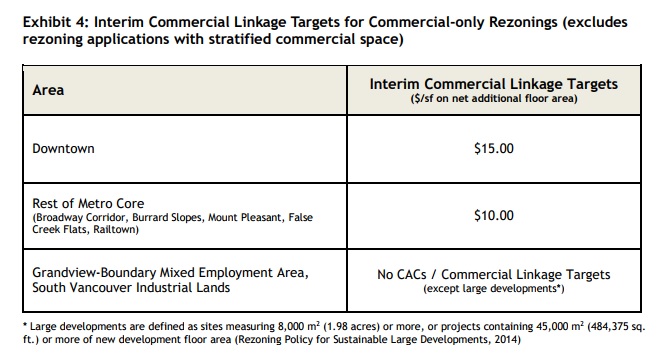

The City intends on removing the CAC negotiation process (which can prolong the application timeline significantly) for commercial applications in the Downtown, Metro Core, Grandview Employment Area and South Vancouver Industrial Lands. This would not apply for proposed stratified commercial space.

The City will also introduce commercial linkage targets, which are intended to show the correlation between additional commercial space and workforce related childcare spaces and affordable housing. The commecial linkage targets will be fixed $/SF amounts calculated on the net additional density for commercial rezonings in the Downtown and Metro Core areas.

The interim Commercial Linkage Targets will be as follows: As industry consultation has already occurred for these items, they could take effect almost immediately after Council adoption.

As industry consultation has already occurred for these items, they could take effect almost immediately after Council adoption.

A full copy of the policy report can be viewed here: http://council.vancouver.ca/20171128/documents/a4.pdf